Navigating the Evolving Landscape of Payday Loans in California

The Future of Payday Loans in California: Trends and Predictions

The payday loan industry in California has undergone significant changes in recent years, driven by evolving consumer preferences, regulatory changes, and technological advancements.

As we look ahead, it's crucial to understand the emerging trends and predict the future trends of payday loans in the Golden State.

Technological Advancements

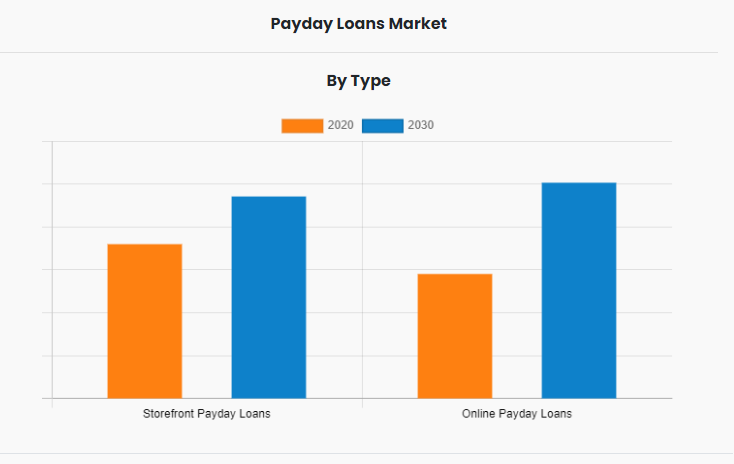

One of the most notable trends shaping the future of payday loans is the integration of technology into lending processes. With the rise of online platforms and digitalization, borrowers now have easier access to payday loans, often receiving funds on the next day after approval.

Furthermore, lenders are using advanced data analytics to streamline loan approvals and offer personalized lending solutions specific to individual needs.

Regulatory Changes

California has been at the forefront of implementing strict regulations to protect consumers from false lending practices. Recent legislative measures, such as interest rate caps and loan rollover restrictions, aim to restrain excessive fees and prevent borrowers from debt traps.

With the government looking more closely at payday loans, we can expect more changes to make sure that there is transparency in online lending practices.

A Modernized Marketplace

The rise of financial technology (Fintech) lenders is revolutionizing access to small payday loans. Here are the advantages they offer:

● Faster Approvals

Get a decision quickly, often within 2-3 minutes, without the hassle of lengthy in-person applications.

● Potentially Lower APRs (Annual Percentage Rate)

Increased competition in the online lending space can lead to more competitive rates for borrowers.

● Transparency at Every Step

Reputable online lenders provide clear and upfront information about loan terms, fees, and repayment dates. This empowers you to make right financial decisions.

● Smaller Loan Amounts

Tailored loan options to meet your specific short term needs, helping you avoid excessive borrowing.

● Extended Repayment Terms

More manageable repayment plans can ease the burden and help you avoid defaulting on the loan.

● Increased Consumer Awareness

Educational initiatives are making California residents more aware of payday loan online options and potential traps. This makes them explore alternatives like credit unions or financial counseling services, promoting long term financial health.

Why are Payday Loans Online Preferred in California?

1. Quick Access to Cash

One of the most important advantages of payday loans is the speed with which borrowers can access funds. In emergencies, when immediate cash is needed for expenses such as medical bills, car repairs, or utility bills, payday loans can provide a timely solution.

Traditional bank loans often take weeks or even months to process, while payday loans can often be approved within a few minutes and the money available the next day.

2. Minimal Requirements

Payday loans are known for their easy accessibility. Unlike traditional loans, which require extensive documentation, payday loans typically require only valid proof of income, identification, and an active bank account. The loan request form is short and simple and can be completed online in a few minutes.

This makes them more accessible to a broader range of people, including those with bad credit histories or no credit history at all.

3. No Hard Credit Check

This is beneficial for individuals who have poor credit scores or past financial difficulties that would disqualify them from obtaining a bank loan. By providing loans without hard credit checks, payday lenders offer financial opportunities to those who might otherwise be excluded from seeking any kind of loan.

4. A Safety Net for the Unbanked

There are individuals in California who do not even have access to traditional banking services. Payday loans can function as a crucial financial safety net. In many cases, payday lenders serve communities that are underserved, offering necessary services that traditional financial institutions will not.

The Rising Popularity of $255 Payday Loans Online in California

California has strict regulations for payday loans to protect consumers from poor lending practices.

California law has limited the maximum amount of money one can receive to $300. For every $100 you borrow, the fee is $15. That simply means that out of $300, the loan fees are $45. So, the maximum amount of money you receive is $255.

A $255 payday loan online is a popular option for Californians because of its overall cost. Consumers can make informed decisions by understanding the cost as well as terms and conditions of payday loans.

Positive Financial Projections for Future

The future of payday loans online in Californians is one of innovation and responsible practices. Here's what we can expect:

● Growth of Safe Alternatives

Fintech direct lenders and non-profit organizations offering small urgent loans are emerging as strong alternatives to conventional payday loans. This broader financial ecosystem empowers borrowers with responsible choices.

● A More Secure Lending Landscape

Increased regulations and industry focus on responsible lending practices will likely create a more secure borrowing process for Californians.

● Balance of Regulation and Accessibility

Future regulations of California are likely to strike a balance between protecting consumer’s financial wellness and maintaining access to quick cash. Thoughtful regulation can ensure that payday loans remain useful for those in need without causing financial hardship.

● Increased Use of Technology

The integration of advanced technology in the lending process has streamlined the application and approval processes of fast cash loans, making payday loans even more convenient. Enhanced security measures and better customer interfaces improve the overall borrowing procedure.

● Sustainable Borrowing Practices

With increased awareness and better consumer education, payday loans can become part of a sustainable borrowing ecosystem. Borrowers will be better equipped to use these fast cash loans to get short term financial relief without falling into a debt trap.

Conclusion

Payday loans in California offer significant benefits, particularly for those in urgent need of fast cash with minimal requirements. As the industry expands, technological advancements, improved financial education, and thoughtful regulation will enhance the positive aspects of payday loans.

By focusing on these benefits and making the right decisions, consumers can continue to rely on payday loans as a valuable financial tool in times of emergencies. The future of payday loans in California looks promising, with trends pointing towards a more balanced, accessible, and user friendly lending landscape.