APR and Interest Rate: Difference Explained

You should always exercise caution when borrowing money to make sure you don't end up spending much more each month than you expected. It's easy to fall into a debt spiral when you don't bother reading terms and agreement details such as APR and interest rates.

Here are important facts to know about these credit terms:

Interest Rate

Interest is the amount of money you pay on for taking out a loan. The principal is the minimum monthly payment, while interest is added and can be a more flexible amount. Look for a lender who will work with you on a repayment plan based on your budgeting needs. To gauge the amount of interest accumulating each month, multiply your remaining loan balance with the number of days since your last payment.

Calculating APR

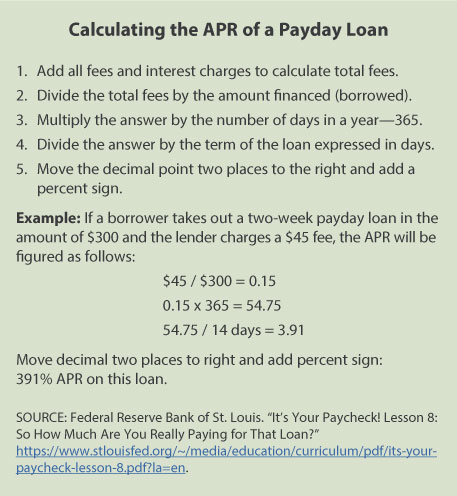

It's always helpful to be aware of your balance, interest rate, and APR, which stands for annual percentage rate instead of a monthly charge. This amount includes document processing and application charges. Keep in mind that loans often end up costing more than the publicized price due to extra charges. APR is calculated by dividing the annual interest amount by the principal loan amount, which produces a percentage.

APR is determined by lenders based on your credit score and multiple other factors. There is an inverse relationship between credit scores and interest rates, as low credit scores lead to high-interest rates. APRs are also affected by various types of transactions.

What is the Difference?

One of the main differences between APR and interest rate is APR has a fixed fee while an interest rate does not. The interest rate is generally lower than the APR. Another key distinction is an interest rate is associated with the regular cost of the loan while the APR reflects the entire cost over the course of the loan.

Conclusion

Paying bills on time should be a top priority for borrowers to avoid paying penalties. Knowing the differences between the interest rate and APR is fundamental to staying out of debt. Make sure you read the terms and agreement thoroughly first before signing a loan deal.

Contact us here at FaaastCash to learn more about APR and interest rate and how we can help you build an emergency fund quickly.